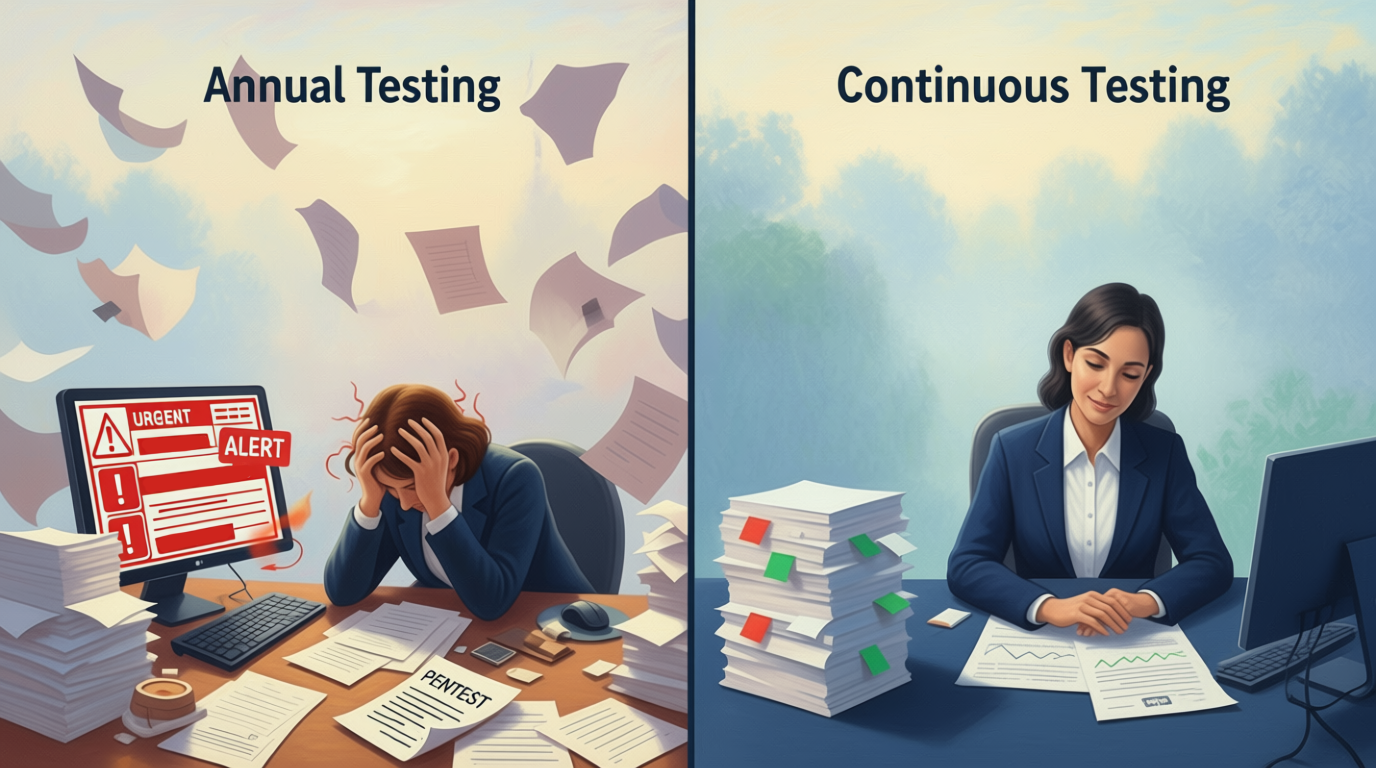

Let's be honest about something: if you're still relying on that once-a-year penetration test to keep your security program humming along, you're probably going to get caught flat-footed. And increasingly, that's not just a security problem, it's become a business problem.

The Problem with "Set It and Forget It" Security Testing

Here's what typically happens: You schedule your annual pentest in Q1, remediate the findings by Q2, and then... nothing. For the next 10 months, your environment evolves. You deploy new features. You migrate services to the cloud. You integrate a new third-party vendor. You upgrade your payment processing system.

Each change potentially introduces new vulnerabilities. But you won't know about them until next year's test rolls around.

Meanwhile, your cyber insurance renewal is coming up. Your carrier wants a recent pentest report. "Recent" used to mean "within the last 12 months," but insurers are getting pickier. Some now want quarterly testing, especially if you're in finance, healthcare, or handle high transaction volumes.

And if you do have an incident? Good luck explaining to your insurer, or your board, why you had a 10-month blind spot between tests.

Why the Rules Changed (And Why They're Not Changing Back)

The shift toward continuous testing isn't just security teams being paranoid. It's being driven by three forces:

- Regulatory Requirements Are Getting Specific

- PCI DSS has always required annual testing, but now explicitly mandates testing after any significant infrastructure change

- GLBA (banking/finance) now requires annual pentests plus semi-annual vulnerability assessments as of June 2023

- HIPAA is expected to mandate annual pentesting by mid-2026, moving from "recommended" to "required"

-

Cyber Insurance Underwriters Are Done Playing Nice

Between 2020-2025, cyber claims outpaced premiums by a massive margin. Insurers responded by tightening underwriting standards. Now they want verifiable and recent proof that you're actively finding and fixing vulnerabilities.

For high-risk industries, insurers are pushing for semi-annual or quarterly testing. They're also setting strict remediation timelines, typically 30-60 days for high-severity findings. Don’t miss your deadlines, and if you do, some carriers will refuse to renew.

- Your Environment Changes Faster Than Annual Testing Can Keep Up With

If you're deploying code weekly (or daily), your attack surface is constantly evolving. That annual test is a snapshot of a system that doesn't exist anymore by the time you get your next one.

Continuous Testing: Less Painful Than It Sounds

This is where PETaaS® (Professionally Evil Testing as a Service) comes in; and no, it's not just "more pentests, more often." It's a different model designed for the way modern organizations actually work and flexible to fit any budget constraints.

Here's what makes it different:

Aligned to Your Release Cycle Instead of scheduling one big test and hoping for the best, testing happens in sync with your development and deployment schedule. New app feature going live? We are on call and able to test it before attackers do.

Findings You Can Actually Use Real-time reporting means vulnerabilities get flagged when they're introduced, not months later when they're baked into production and harder to fix. Developers can address issues while the code is still fresh in their minds, and we collaborate with you in real-time to make those results happen.

Insurance-Ready Documentation Every test generates the compliance-grade documentation your insurer (or auditor) needs to see. When renewal time comes around, you're not scrambling for reports and have evidence that you're actively managing risk.

Retesting Without the Procurement Dance Validation testing is built in at no additional cost. You're not waiting months or negotiating new SOWs to confirm the issue is actually resolved or waiting weeks for a report as evidence.

Who Actually Needs This?

Not everyone needs continuous testing. If you're a low-risk organization with minimal infrastructure changes, annual testing might still be fine. But if you check any of these boxes, it's worth the conversation:

Finance & Banking: GLBA compliance requires annual testing plus semi-annual scans. High transaction volumes make you a constant target. Quarterly testing is becoming the norm for cyber insurance eligibility.

Healthcare: With HIPAA pentesting mandates coming in 2026 and zero tolerance for breaches from insurers, continuous testing helps you stay ahead of both regulatory and coverage requirements.

Payment Processing: PCI DSS requires annual testing and testing after significant changes. If you're making frequent updates to your cardholder data environment, you're essentially always supposed to be testing.

Tech Companies with Rapid Development Cycles: If you're deploying new code multiple times a week, annual testing leaves dangerous gaps. You need testing that keeps pace with your release schedule.

Organizations Facing Insurance Premium Increases: If your cyber insurance costs are climbing, demonstrating a continuous testing program can be a negotiating tool for better rates and coverage terms.

The Bottom Line

Here's the reality: continuous testing used to be a "nice to have" for security-mature organizations. It's rapidly becoming table stakes.

Regulators are codifying it into compliance requirements. Insurers are making it a condition of coverage. And the business cost of getting breached in that 10-month gap between annual tests? That's not a risk most organizations can afford anymore.

The good news: shifting to a continuous testing model doesn't have to be painful. It's about building security testing into your normal operating rhythm instead of treating it as an annual fire drill.

At Secure Ideas, our PETaaS® offering is designed specifically to give you the flexibility to test as often as your environment, industry, and risk profile demand. Whether that's quarterly, monthly, or aligned to specific release cycles, the goal is the same: find vulnerabilities before attackers do, and make sure you're never caught empty-handed when insurance renewals or audits come around.

Want to talk through what continuous testing would look like for your organization?

Reach out, we're happy to discuss whether it makes sense for your specific situation.